On page 49 of the Veteran's Benefits Handbook (2007) you will find the following under the title of this post: (NOTE: please read all of this post as keys will be pointed out regarding this program)

"A veteran who was discharged under other than dishonorable conditions and who has a service-connected disability but is otherwise in good health may apply to VA for up to $10,000 in life insurance coverage under the Service-Disabled Veterans's Insurance (S-DVI) program. Applications must be submitted within two years from the date of being notified of the approval of a new service-connected disability by VA. this insurance is limited to veterans who left service on or after April 25, 1951.

Veterans who are totally disabled may apply for a waiver of premiums and additional supplemental coverage of up to $20,000. However, premiums cannot be waived on the additional insurance. To be eligible for this type of supplemental insurance, veterans must meet all of the following four requirements.

1. Be under age 65.

2. Meet the requirements of total disability

3. Have as S-DVI policy with premiuns waived due to total disability.

4. Apply for additional insurance with one year from the date of notification of waiver approval on the S-DVI policy.

Several question may arise reguarding this type of policy, which I will attempt to clarify below.

In paragraph one you will note the bold, underlined portions. What does "is otherwise in good health" mean? It means that if you have 100% SC disabilities but are dying of cancer, heart problems, or any illness that is considered terminal you may not be eligable for this coverage, even if your disability rating is for these illnesses.

In the same paragraph please note the bold, underlined portion. Note that the sentence say "NEW service connected disability." This means that if you are rated at 100%, yet, you file a claim for an additional SC condition and that claim is granted you CAN file for this insurance based on that new approved claim, even if it is on and above you already 100% rated condition as long as you are still considered "in good health."

I suggest that if you are rated at 100% total disability and have a SC connected condition, for which you have not filed a claim, and you wish to take advantage of this insurance coverage, that you file a claim on said condition today. Remember, you have to expect delays in getting a new claim granted so if you are 64 years old and feel that your claim will not be granted before you turn 65, you will probably not qualify for this coverage based on the above age requirement.

If you know of veterans who may meet the requirement of this policy coverage, please, inform them of this post and have them come to the site and read this post, or refer them to the Veteran's Benefits Handbook.

If you have any questions regarding this post please do not hesitate to ask them as others may benefit from your question(s).

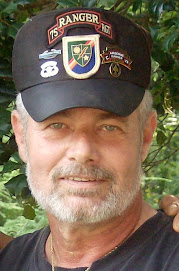

Rocky

173rd Airborne Brigade (SEP)

Charlie Co. 75th Rangers

Vietnam 1967-70

VA Service Officer "C" Rangers

http://www.e20-lrp-c75-rgr.org

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment